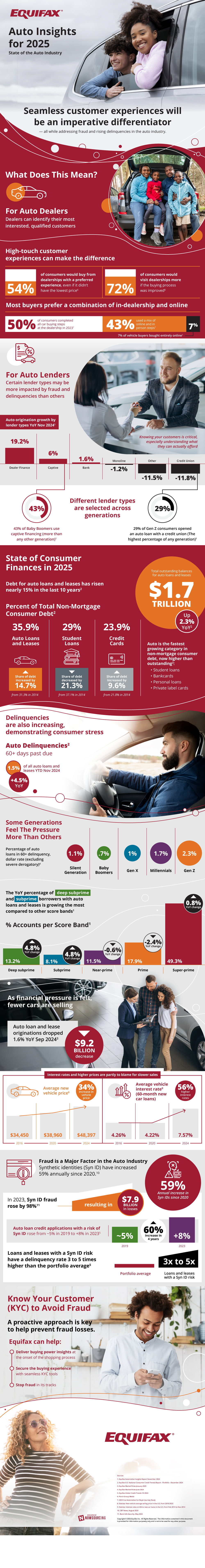

Growing concerns over affordability as well as delinquencies and the rising threat of synthetic identity fraud are pushing auto dealers and lenders to enhance their fraud prevention solutions while improving customer interactions to stand out from the competition.

Having personalized customer interactions and improving the buying process will not only attract more buyers to dealerships but also help auto dealers know who are their best customers. Auto lenders can tailor their offerings and minimize risks if they know which lender types are preferred between generations. It is crucial for both dealers and lenders to understand what customers can actually afford so they can present the best offers and create strong customer relationships.

Current auto finance trends are showing that debt for auto loans and leases have increased the most out of all the non-mortgage consumer debt categories, with the total outstanding balances approaching $2 trillion. Consumer stress, especially for Gen Z consumers, can be felt through rising auto delinquency rates. Deep subprime and subprime borrowers with auto loans and leases are growing as well. The financial stress that many are facing and rising vehicle interest rates are making it more challenging for cars to sell.

Fraud is another issue auto dealers and lenders must address, particularly synthetic identity (Syn ID) fraud. Syn ID fraud alone has resulted in almost $8 billion in losses for the industry in 2023. In fact, loans and leases with a Syn ID risk tend to experience much higher delinquency rates than regular loans and leases, up to five times greater.

Auto dealers and lenders who understand their customers and cater services to their specific needs while proactively implementing fraud prevention solutions will be the ones to attract the right buyers and continue to thrive in the industry.