The Stochastics oscillator, created by George Path during the 1950s, tracks the advancement of trading pressure, recognizing cycle turns that substitute power among bulls and bears. Scarcely any merchants exploit this prescient device since they don’t have the foggiest idea about how best to join explicit methodologies and holding periods. It’s a simple fix, as you will find in this speedy introduction on Stochastics settings and understanding.stochastic oscillator best settings

Stochastics Development

The advanced or “Full Stochastics” oscillator consolidates components of Path’s “slow stochastics” and “quick stochastics” into three factors that control think back periods and degree of information smoothing.

Quick K% – measures the end value contrasted with indicated lookback periods.

Full K% or K% dials back Quick K% with a Straightforward Moving Normal (SMA).

Full D% or D% adds a second smoothing normal.

Lower Quick K%, K% and D% factors = a more limited term lookback period with less smoothing

Higher Quick K%, K% and D% factors = a more extended term lookback period with more prominent smoothing

Picking The Best Settings

Pick the best factors for your exchanging style by concluding how much clamor you’re willing to acknowledge with the information. Grasp that anything you pick, the more experience you have with the pointer will work on your acknowledgment of dependable signs Stochastic Oscillator. Transient market players will more often than not pick low settings for all factors since it gives them prior signals in the exceptionally serious intraday market climate. Long haul market clocks will generally pick high settings for all factors on the grounds that the exceptionally smoothed yield just responds to significant changes in cost activity.stochastic oscillator best settings

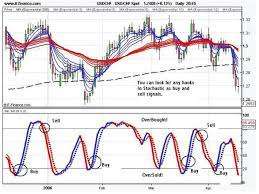

SPDR S&P 500 Trust (SPY) shows different Stochastics impressions, contingent upon factors.

Cycle turns happen when the quick line crosses the sluggish line in the wake of coming to the overbought or oversold level. The responsive 5,3,3 setting flips trade cycles much of the time, frequently without the lines coming to overbought or oversold levels. The mid-range 21,7,7 hindering glances at a more drawn out period yet keeps smoothing at somewhat low levels, yielding more extensive swings that create less trade signals. The drawn out 21,14,14 impairing makes a monster stride, flagging cycle turns once in a long while and just close to key market defining moments.

More limited term factors evoke before signals with higher clamor levels while longer term factors inspire later signals with lower commotion levels, besides at significant market turns when time periods will generally arrange, setting off indistinguishably coordinated signals across significant information sources. You can witness this at the October low, where the blue square shape features bullish hybrids on each of the three forms of the pointer. These enormous cycle hybrids let us know that settings are less significant at significant defining moments than our expertise in separating commotion levels and responding to new cycles. From a calculated stance, this frequently implies finishing off pattern following positions and executing blurring methodologies that purchase pullbacks or sell rallies.stochastic oscillator best settings

Stochastics and Example Investigation

Stochastics don’t need to arrive at outrageous levels to bring out solid signs, particularly when the cost design shows regular obstructions. While the most significant turns are normal at overbought or oversold levels, crosses inside the focal point of the board can be relied upon the length of eminent help or obstruction levels line up. Moving midpoints, holes, trendlines or Fibonacci retracements will frequently mediate, shortening a cycle’s length and flipping capacity to the opposite side. This features the significance of perusing the cost design simultaneously you decipher the pointer.

American Carriers Gathering (AAL) mobilized over the 50-day EMA after an unpredictable downfall and settled at new help (1), driving the marker to turn higher prior to coming to the oversold level. It broke out over a 2-month trendline and pulled back (2), setting off a bullish hybrid at the midpoint of the board. The ensuing meeting switched at 44, yielding a pullback that tracks down help at the 50-day EMA (3), setting off a third bullish turn over the oversold line.

The Reality

Numerous dealers neglect to take advantage of the force of Stochastics on the grounds that they are befuddled about getting the right settings for their market techniques. These accommodating tips will cure that trepidation and assist with opening more potential.stochastic oscillator best settings

Contend Chance Free with $100,000 in Virtual Money

Put your exchanging abilities under a magnifying glass with our FREE Stock Test system. Contend with large number of Investopedia brokers and exchange your direction to the top! Submit exchanges a virtual climate before you begin gambling with your own cash Stochastic Oscillator. Work on exchanging systems so that when you’re prepared to enter the genuine market, you’ve had the training you want. Attempt our Stock Test system today